Samsung Pay has recently partnered with SoFi, a personal finance company, to provide a seamless money management platform right inside Samsung Pay.

EWALLET APPS UPDATE

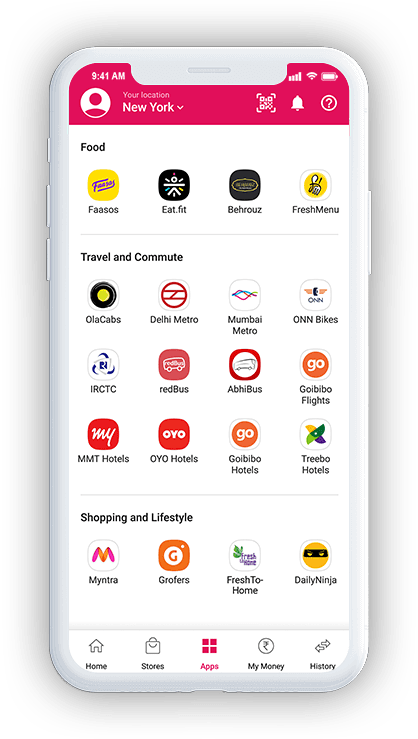

For example, Google is working on a GooglePlex update to its Google Pay wallet, which will provide savings and checking accounts from leading banks. Related: Smart Contract App Development: The Complete Guide Partnerships with banksįirst, mobile wallets have taken down standalone e-wallets by major banks, and now they want to step back and integrate with banking services to offer more value to their customers. For example, Venmo allows its customers to trade the most popular cryptocurrencies, while PayPal does the same and, on top of that, supports crypto payments. Now, it looks like e-wallets want to go further by connecting to decentralized finance services (DeFi) and crypto. For example, most mobile wallets allow us to add gift cards, passcards, rewards, coupons, and other cards with monetary value, besides the ubiquitous debit and credit cards. For now, let’s focus on a couple of trends I’m noticing with these solutions.īeing a virtual representation of our physical wallets, digital wallets have fewer restrictions in terms of what they can hold. We’ll discuss different types of e-wallets and check out the most successful ones in the following sections. That said, many other digital wallets are competing for consumers’ attention in the US, including Venmo, PayPal, Cash App, Walmart Pay, Facebook Pay. Compare these graphics to see what Apple Pay, Google Pay, and Samsung Pay have been able to achieve in five years: It also seems that the mobile wallets from tech giants like Apple, Google, and Samsung outperform all other competitors in the space.

EWALLET APPS HOW TO

In this blog, you’ll learn how to create a wallet app, some of the best practices, and what you need to win in this highly competitive niche. If you’ve identified a unique opportunity and want to create a digital wallet, you’re in the right place. They fit in a smartphone (no need to carry those bulky physical wallets), provide more robust security (compared to flashing a credit card in public), and allow us to pay virtually for anything (and do so much more) from the comfort of our homes.

0 kommentar(er)

0 kommentar(er)